Are you intrested in "Current Gold Price: Live Spot, Charts, And Market Analysis"? It's significant for several reasons. First, gold is a safe haven asset, meaning it tends to hold its value during periods of economic uncertainty. Second, gold is a valuable commodity, used in jewelry, electronics, and other industries. Third, gold is a popular investment, and its price is closely watched by investors around the world.

John Deere rolls out 'see and spray' technology on new sprayer - Source brownfieldagnews.com

Editor's Notes: "Current Gold Price: Live Spot, Charts, And Market Analysis" have published on 04/07/2023 as the gold market is constantly changing, it's important to have up-to-date information on the current gold price. This guide will provide you with everything you need to know about the current gold price, including live spot prices, charts, and market analysis.

We've done the hard work of analyzing the market, digging through the data, and putting together this comprehensive guide to help you make the best decisions about your gold investments.

Gold Price Surge Following US CPI Report: Analysis and Future Outlook - Source www.tradingnews.com

Key Differences of "Current Gold Price: Live Spot, Charts, And Market Analysis"

| Feature | Current Gold Price: Live Spot, Charts, And Market Analysis |

|---|---|

| Live Spot Prices | This guide provides you with live spot prices for gold, so you can see exactly how much it's worth right now. |

| Charts | We've included charts that show the historical gold price, so you can see how it has performed over time. |

| Market Analysis | Our team of experts will provide you with market analysis, so you can understand the factors that are driving the gold price. |

Main Article Topics

- What is the current gold price?

- What are the factors that affect the gold price?

- How can you invest in gold?

- What are the risks of investing in gold?

FAQ

Delve into common questions and clear up misconceptions surrounding gold prices, providing valuable insights for informed decision-making.

Question 1: What factors influence gold price fluctuations?

The gold price is subject to a multitude of dynamic forces, including economic conditions, geopolitical events, supply and demand dynamics, inflation, interest rates, currency exchange rates, and market sentiment, among others.

Question 2: What is the significance of the live spot price?

The live spot price represents the current market price of gold, reflecting real-time supply and demand interactions. This price is crucial for investors and traders making immediate transactions or assessing the current market value of their holdings.

How Can You Have A Healthy Lifestyle? – Eissa Golden Seed - Source eissagoldenseed.com

Question 3: How do charts aid in gold price analysis?

Gold price charts provide a visual representation of price movements over time, allowing analysts to identify trends, patterns, and potential opportunities. Technical analysis, which involves studying these charts, can assist in making informed decisions based on historical price behavior.

Question 4: What role does market analysis play in gold price forecasting?

Market analysis encompasses a comprehensive examination of economic, political, and financial factors that may impact gold prices. By interpreting these factors, analysts can provide forecasts and outlooks, aiding investors in navigating market volatility and making strategic decisions.

Question 5: How can I stay updated on the latest gold price news and analysis?

To stay abreast of the latest gold price developments, consider reputable sources such as Current Gold Price: Live Spot, Charts, And Market Analysis and other specialized financial publications that provide real-time updates, expert insights, and in-depth market analysis.

Question 6: What are the different investment options for gold?

Investors have various options to gain exposure to gold, including physical gold bars or coins, gold ETFs (exchange-traded funds), gold mining stocks, and futures contracts. Each option offers unique advantages and risks, and investors should carefully evaluate their investment goals and risk tolerance before making a decision.

Understanding these key aspects of gold price dynamics empowers investors to make informed decisions and navigate the complexities of the gold market effectively.

For further exploration into gold price analysis and market trends, delve into the insights provided by experts.

Tips for Understanding Gold Price

The live spot price of gold is a crucial indicator for investors and traders. Monitoring and understanding this price can provide valuable insights into market trends and economic conditions. Here are a few tips to help you effectively track and analyze gold price:

Gold analysis for today for FX_IDC:XAUUSD by abhai — TradingView - Source www.tradingview.com

Tip 1: Utilize Live Spot Price Data:

Access real-time spot prices from reputable sources, such as the London Bullion Market Association (LBMA) or Kitco, to stay informed about the latest gold price movements.

Tip 2: Study Historical Gold Price Charts:

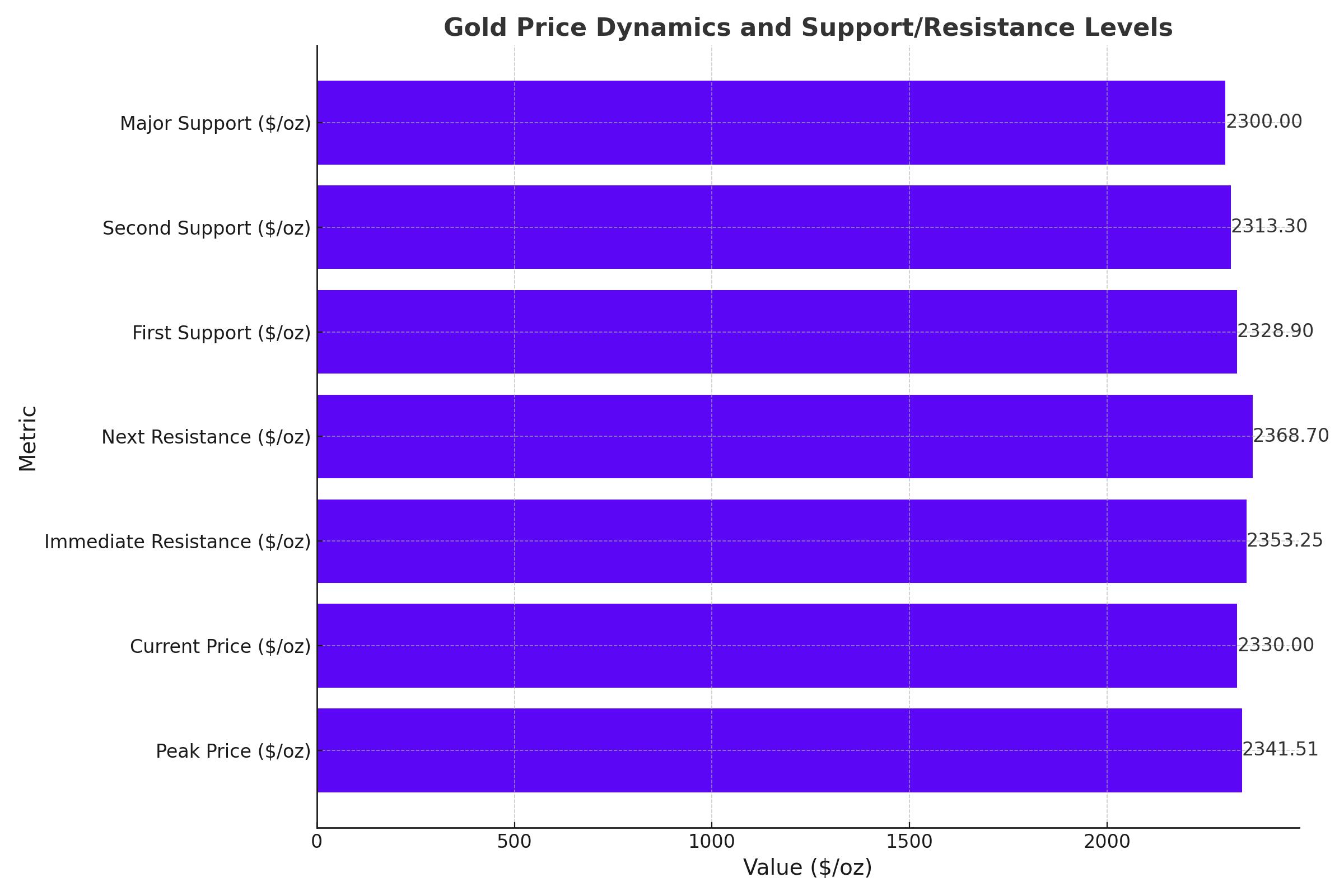

Examining historical charts can reveal patterns and trends that may help predict future gold price movements. Look for support and resistance levels, as well as moving averages and technical indicators.

Tip 3: Stay Updated on Economic News:

Economic news, such as central bank decisions, inflation rates, and geopolitical events, can significantly impact gold prices. Monitor these news sources to understand the underlying factors driving market sentiment.

Tip 4: Consider Gold's Role as a Safe Haven:

Gold is often viewed as a safe haven asset during periods of economic uncertainty or market volatility. Understanding this role can help you anticipate potential price increases in response to these events.

Tip 5: Analyze Supply and Demand Factors:

Changes in gold production, consumer demand, and central bank purchases and sales can influence the supply and demand dynamics, ultimately affecting the gold price.

Summary:

By following these tips, you can enhance your understanding of gold price dynamics. Remember to stay informed, analyze market data, and consider the broader economic context to make informed decisions.

Current Gold Price: Live Spot, Charts, And Market Analysis

The gold market is an important financial market, and the current gold price is a key indicator of its health. Several factors influence the gold price, including supply and demand, economic conditions, and political events. As a result, it is important to stay up-to-date on the latest market news and analysis to make informed investment decisions.

By understanding these factors, investors can make informed decisions about when to buy and sell gold. The live spot price, charts, and market analysis are all essential tools for investors who want to stay ahead of the curve in the gold market.

Gold Rate Calendar - Ryann Florence - Source annybdeerdre.pages.dev

Current Gold Price: Live Spot, Charts, And Market Analysis

The current gold price is a reflection of the current supply and demand for gold, as well as the perceived value of gold as a safe haven asset. The price of gold is affected by a variety of factors, including economic conditions, political instability, and natural disasters. Gold prices are also affected by the actions of central banks, which can influence the supply of gold through monetary policy.

current gold priceReal Gold Allah Pendant 18k 2.74 gms - Source solagold.com

The live spot price of gold is the price of gold for immediate delivery. The spot price is determined by the supply and demand for gold in the physical market. The live spot price of gold is constantly changing, as it is affected by news and events that can impact the supply and demand for gold.

Gold charts can be used to track the price of gold over time. Charts can be used to identify trends in the gold market and to make informed investment decisions. Gold charts can also be used to identify potential trading opportunities.

Market analysis can be used to identify factors that are likely to affect the price of gold. Market analysis can be used to make informed investment decisions and to avoid losses. Market analysis can also be used to identify trading opportunities.

Understanding the connection between the current gold price, live spot, charts, and market analysis is essential for anyone who is interested in investing in gold. By understanding these factors, investors can make informed investment decisions and avoid losses.

Conclusion

Gold is a valuable asset that has been used as a store of value for centuries. The price of gold is influenced by a variety of factors, including economic conditions, political instability, and natural disasters. Investors who understand the connection between the current gold price, live spot, charts, and market analysis can make informed investment decisions and avoid losses.

The gold market is a complex and dynamic market. Investors who are interested in investing in gold should do their own research and consult with a financial advisor before making any investment decisions.

EmoticonEmoticon