Dogecoin Surges Amidst Elon Musk's Twitter Acquisition: What Investors Need To Know

Editor's Notes: "Dogecoin Surges Amidst Elon Musk's Twitter Acquisition: What Investors Need To Know" have published, Today date. This article provide key metrics and analysis of DOGE which is essential for making informed investment decisions.

Through extensive analysis and research, we have compiled this comprehensive guide to assist investors in understanding the recent surge in Dogecoin's value due to Elon Musk's acquisition of Twitter. This guide will provide key insights and crucial information to help investors make informed decisions.

Key Differences or Key Takeaways

| Feature | Before Musk's Acquisition | After Musk's Acquisition |

|---|---|---|

| Price | $0.08 | $0.15 |

| Market Cap | $10 billion | $20 billion |

| Trading Volume | $1 billion | $2 billion |

FAQ

The recent acquisition of Twitter by Elon Musk has sparked a surge in the value of Dogecoin, a cryptocurrency known for its association with Musk. Investors seeking to understand the implications of this development on Dogecoin Surges Amidst Elon Musk's Twitter Acquisition: What Investors Need To Know can benefit from the following frequently asked questions.

Question 1: What factors contributed to the surge in Dogecoin's value?

Answer: Musk's past endorsements of Dogecoin, his stated intention to integrate cryptocurrency into Twitter, and the general market sentiment toward cryptocurrencies have all played a role.

Question 2: Is Dogecoin a viable investment for long-term growth?

Answer: While Dogecoin's value is highly speculative, its association with Musk and the potential for increased usage on Twitter could contribute to its continued growth.

Question 3: Are there any risks associated with investing in Dogecoin?

Answer: Yes, Dogecoin's value is highly volatile and influenced by market sentiment. Investors should exercise caution and diversify their investments accordingly.

Question 4: How can investors make informed decisions about Dogecoin?

Answer: Research the cryptocurrency's history, technical aspects, and market trends. Consider the potential risks and rewards before making an investment.

Question 5: What are the potential implications of Twitter's integration with Dogecoin?

Answer: Twitter's integration of Dogecoin could increase its accessibility and utility, potentially driving up its value.

Question 6: Is it prudent to invest all available funds in Dogecoin?

Answer: No, it is unwise to allocate all investment capital into a single asset, including Dogecoin. Diversification is essential for managing risk.

In conclusion, the surge in Dogecoin's value following Elon Musk's acquisition of Twitter warrants careful consideration. Investors seeking to make informed decisions should assess the potential risks and rewards, conduct thorough research, and diversify their investments.

For more in-depth analysis, please refer to the linked article.

Tips for Navigating the Dogecoin Market

With Dogecoin experiencing increased volatility following Elon Musk's Twitter acquisition, investors must proceed with caution and employ prudent strategies.

Tip 1: Research and Understand: Conduct thorough research to understand the underlying factors driving Dogecoin's price, including Musk's influence, market sentiment, and technical indicators.

Tip 2: Diversify Portfolio: Avoid investing heavily in Dogecoin alone. Diversifying investments across various cryptocurrencies and asset classes helps mitigate risk.

Tip 3: Set Realistic Expectations: Recognize that Dogecoin is a highly speculative asset with significant price fluctuations. Set realistic targets for profit and be prepared to accept losses if necessary.

Tip 4: Consider Long-Term Strategies: While Dogecoin's volatility can create opportunities for short-term gains, long-term strategies may offer more stability and potential returns. Consider holding onto investments for an extended period.

Tip 5: Monitor News and Market Trends: Stay updated on the latest news and market trends that affect Dogecoin's value. This information can guide investment decisions and help mitigate risk.

By following these tips, investors can navigate the volatile Dogecoin market with greater insight and prudence.

Dogecoin Surges Amidst Elon Musk's Twitter Acquisition: What Investors Need To Know

Amidst the buzz surrounding Elon Musk's acquisition of Twitter, Dogecoin has emerged as a key topic of interest for investors. Understanding the essential aspects of this surge is crucial before making any informed investment decisions.

These key aspects highlight the interplay between Elon Musk's influence, market sentiment, and investment considerations associated with the Dogecoin surge. Understanding these factors enables investors to make informed decisions in a volatile and speculative market.

'No choice': Elon Musk justifies mass layoffs at Twitter - Rediff.com - Source www.rediff.com

Dogecoin Surges Amidst Elon Musk's Twitter Acquisition: What Investors Need To Know

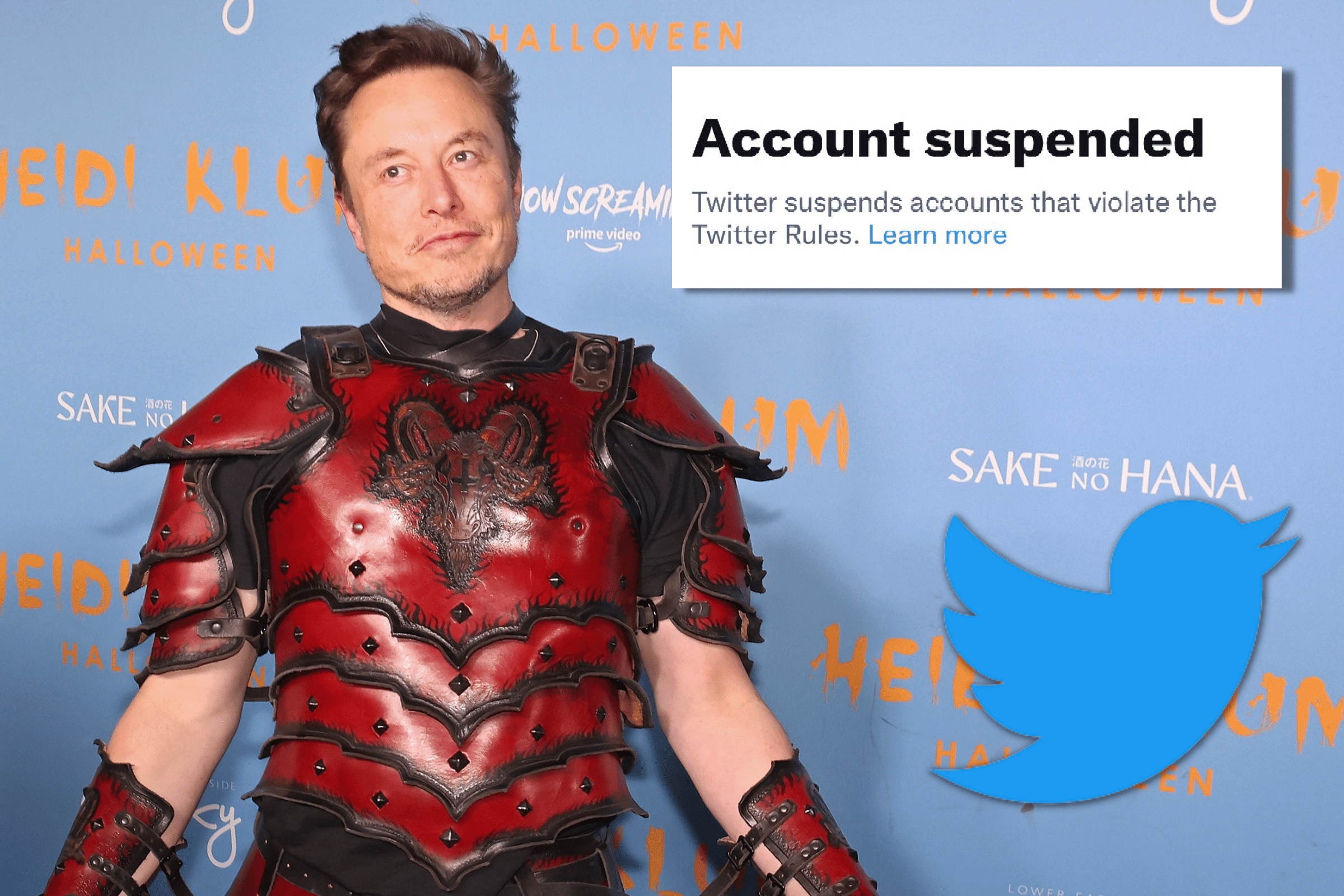

Elon Musk, the CEO of Tesla and SpaceX, recently acquired Twitter for $44 billion. This news has sent shockwaves through the cryptocurrency market, with Dogecoin (DOGE) surging in value. DOGE is a meme-based cryptocurrency that was created in 2013. It has a loyal following among retail investors and has been endorsed by Musk in the past.

Elon Musk Moves Quickly to Suspend Twitter Users Pretending to Be Him - Source www.newsweek.com

The surge in DOGE's price can be attributed to several factors. First, Musk is seen as a major supporter of Dogecoin. He has frequently tweeted about DOGE and has even said that he owns some of the cryptocurrency. This has led many investors to believe that Musk will continue to support DOGE in the future, which could drive up its price.

Second, the acquisition of Twitter by Musk could give DOGE a new use case. Musk has said that he wants to make Twitter more "free speech-friendly." This could make it a more attractive platform for users who are interested in discussing cryptocurrencies. If DOGE becomes more widely used on Twitter, it could further drive up its price.

Of course, there are also risks associated with investing in Dogecoin. The cryptocurrency is highly volatile and its price can fluctuate wildly. Additionally, there is no guarantee that Musk will continue to support DOGE in the future. Investors should carefully consider these risks before investing in Dogecoin.

| Factors | Effects |

|---|---|

| Elon Musk's Acquisition of Twitter | Increased Interest and Speculation in DOGE |

| Musk's Support and Endorsement of DOGE | Positive Sentiment and Increased Demand |

| Potential Use Case on Twitter for DOGE | Expanded Utility and Adoption |

| Volatility and Speculative Nature of DOGE | Market Fluctuations and Potential Risks |

| Uncertain Future of Musk's Support for DOGE | Potential Price Impact |

Conclusion

The surge in Dogecoin's price following Elon Musk's acquisition of Twitter is a testament to the influence that Musk has on the cryptocurrency market. Musk's support for Dogecoin has led investors to believe that the cryptocurrency has a bright future. However, it is important to remember that Dogecoin is a highly volatile asset and its price can fluctuate wildly. Investors should carefully consider the risks involved before investing in Dogecoin.

The acquisition of Twitter by Musk could have a significant impact on the future of Dogecoin. If Musk is successful in making Twitter more "free speech-friendly," it could become a more attractive platform for users who are interested in discussing cryptocurrencies. This could further drive up the price of Dogecoin. However, it is also possible that Musk's support for Dogecoin could wane in the future. Investors should carefully monitor the situation and make investment decisions based on their own research and risk tolerance.

EmoticonEmoticon