Gold Price: Real-Time Spot And Historical Charts Are you looking for real-time spot and historical gold price data?

How Gold Performs During Recessions? | GoldBroker.com - Source goldbroker.com

Editor's Note: "Gold Price: Real-Time Spot And Historical Charts" has published today date and must read if you want to know more about gold.

Our team have analyzed and dug variety of information sources we have put together this Gold Price: Real-Time Spot And Historical Charts guide to help you make the right decision.

| Key Differences | Key Takeaways |

| Real-time gold prices | Gold prices are constantly fluctuating, so it is important to have access to real-time data to make informed decisions. |

| Historical gold prices | Historical data can help identify trends and patterns that can assist investors. |

Transition to main article topics

FAQ

Here are some frequently asked questions about gold prices, with their respective answers:

Buy IIDVERT Charizard&Blastoise Custom Metal VMAX Card (Rainbow Gold - Source www.desertcart.com.au

Question 1: What factors influence the price of gold?

Answer: The price of gold is influenced by various factors, including supply and demand, interest rates, inflation, economic conditions, and geopolitical uncertainties.

Question 2: How can I track the real-time spot price of gold?

Answer: You can track the real-time spot price of gold on websites that provide financial data, such as Gold Price: Real-Time Spot And Historical Charts.

Question 3: What is the difference between the spot price and the historical price of gold?

Answer: The spot price represents the current market price of gold, while the historical price refers to the price of gold at a specific point in the past.

Question 4: Is investing in gold a good way to hedge against inflation?

Answer: Gold is often considered a hedge against inflation, as its value tends to increase during periods of rising prices.

Question 5: What are the advantages of investing in physical gold over paper gold?

Answer: Investing in physical gold provides the advantage of direct ownership and tangible possession of the asset, while paper gold, such as gold ETFs, represents a claim to gold ownership.

Question 6: How can I store gold securely?

Answer: There are several ways to store gold securely, including keeping it in a home safe, renting a safe deposit box, or storing it with a reputable depository.

These are just a few of the common questions about gold prices. For more information, please refer to reputable financial sources.

Moving on to the next section: Understanding Gold Price Fluctuations

Tips for Understanding Gold Price Charts

Gold price charts provide valuable insights into the market trends and fluctuations of the precious metal. By following these tips, investors and traders can effectively analyze and interpret gold price charts to make informed decisions.

Tip 1: Identify the Time Frame: Determine the specific time period that the chart covers, whether it's daily, weekly, monthly, or yearly. This helps in understanding the short-term or long-term trends.

Tip 2: Analyze the Trend: Identify the overall direction of the gold price. Is it increasing, decreasing, or moving sideways? This indicates the market sentiment and momentum.

Tip 3: Observe Support and Resistance Levels: Support levels are points where the gold price rebounds after a decline, while resistance levels are points where the price meets resistance and reverses. Identifying these levels can provide insights into market momentum.

Tip 4: Use Technical Indicators: Technical indicators, such as moving averages, Bollinger Bands, and relative strength index (RSI), can help identify market trends, overbought or oversold conditions, and potential trading opportunities.

Tip 5: Consider Fundamental Factors: While technical analysis focuses on the price action, it's also crucial to consider fundamental factors that may influence gold prices, such as economic conditions, inflation, and global events.

Tip 6: Compare to Other Precious Metals: Comparing gold's price with other precious metals, like silver and platinum, can provide insights into relative market performance and potential hedging opportunities.

Tip 7: Use a Reputable Source: Ensure that the gold price chart is from a reliable and up-to-date source to ensure the accuracy of the data.

By following these tips, investors and traders can effectively navigate gold price charts to gain a comprehensive understanding of market trends and make informed investment decisions.

Gold Price: Real-Time Spot And Historical Charts

Essential aspects of gold price tracking include current market value, historical trends analysis, economic indicators impact, supply and demand dynamics, and future price projections.

- Spot Price: Real-time market value

- Historical Charts: Trend analysis over time

- Economic Factors: Influence on price

- Supply and Demand: Market dynamics

- Forecasts: Future price predictions

- Technical Analysis: Price patterns and indicators

Tracking gold price with real-time spot and historical charts provides valuable insights into market fluctuations, allowing investors and traders to make informed decisions. Historical trends help identify patterns and predict future movements. Economic indicators, such as interest rates and inflation, significantly impact gold prices. Understanding supply and demand dynamics, including production and consumption, is crucial. Technical analysis offers additional insights by studying price charts and patterns. By considering these aspects, individuals can better understand the multifaceted nature of gold price movements.

What Happens To Bitcoin Price If Spot ETF Is Approved? - Source www.newsbtc.com

Gold Price: Real-Time Spot And Historical Charts

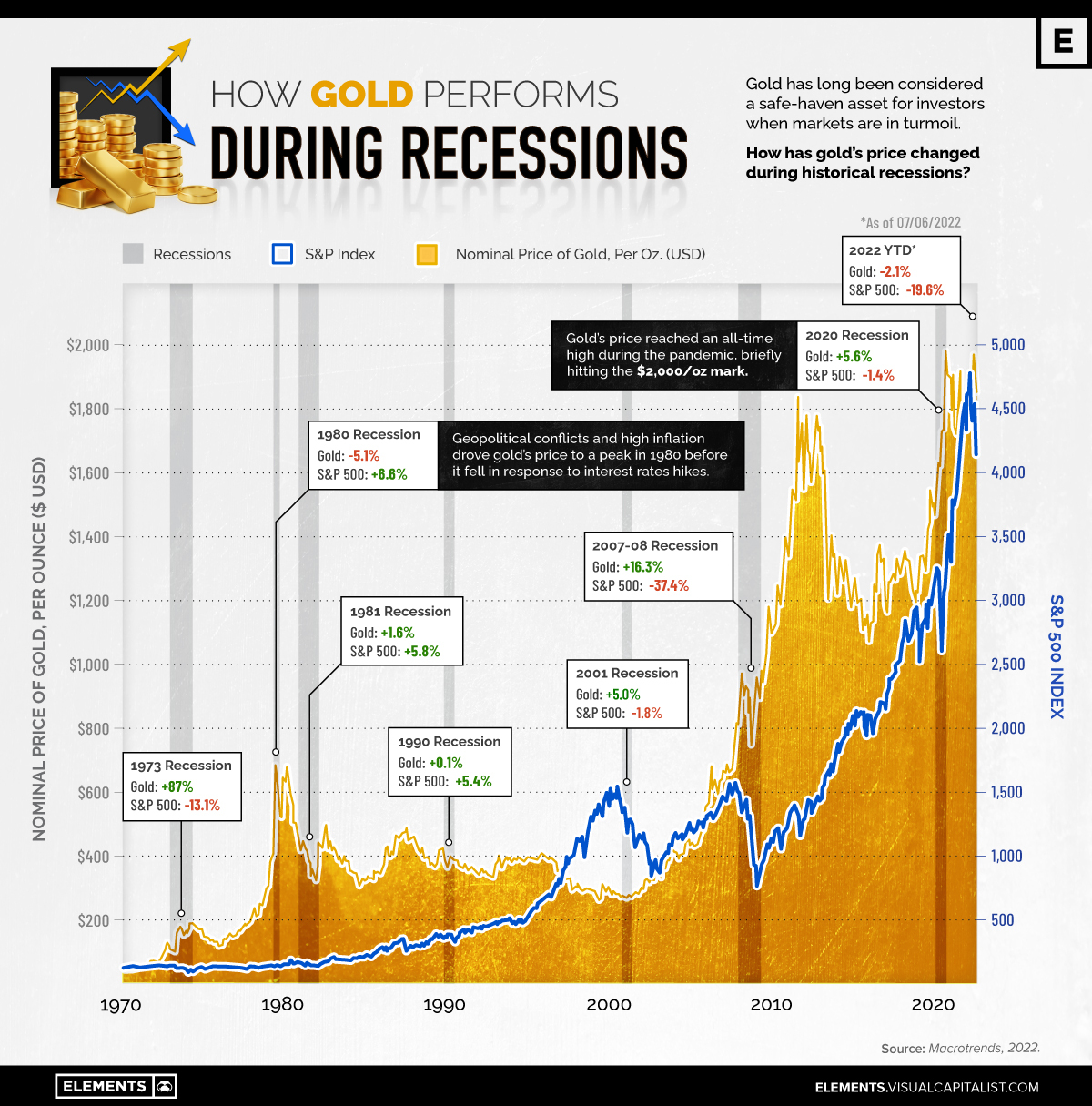

The gold price is a key indicator of the global economy. It is used as a safe haven asset by investors during times of uncertainty, and its price is influenced by a variety of factors, including interest rates, inflation, and geopolitical events. Real-time spot prices and historical charts provide valuable insights into the current and past performance of gold, and can be used to make informed investment decisions.

Infation and the national debt, not a concern yet – Grey Enlightenment - Source greyenlightenment.com

Real-time spot prices show the current market price of gold, while historical charts show the price of gold over time. This information can be used to identify trends and patterns in the gold market, and to make informed trading decisions. For example, an investor who notices that the gold price is rising may decide to buy gold in anticipation of further price increases. Conversely, an investor who notices that the gold price is falling may decide to sell gold to avoid losses.

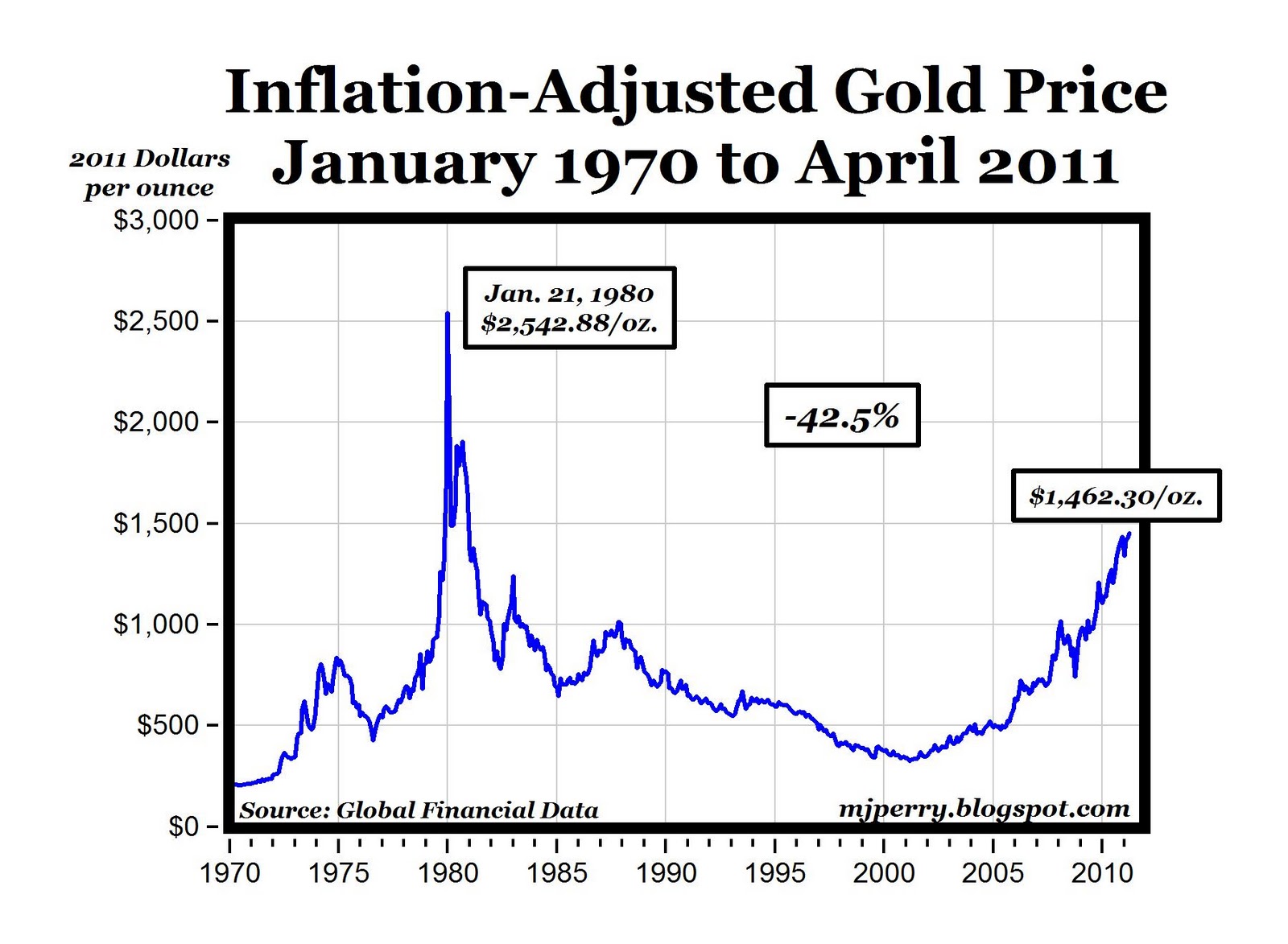

Historical charts can also provide insights into the long-term performance of gold. For example, an investor who examines a historical chart of the gold price may notice that it has a tendency to rise during periods of economic uncertainty. This information can be used to make informed investment decisions, such as buying gold when the economy is expected to enter a recession.

Real-time spot prices and historical charts are essential tools for anyone who is interested in investing in gold. This information can be used to make informed trading decisions, and to identify trends and patterns in the gold market.

| Feature | Benefit |

|---|---|

| Real-time spot prices | Show the current market price of gold |

| Historical charts | Show the price of gold over time |

| Trends and patterns | Can be used to make informed trading decisions |

| Long-term performance | Can be used to make informed investment decisions |

Conclusion

Real-time spot prices and historical charts are essential tools for understanding the relationship between "Gold Price: Real-Time Spot And Historical Charts". This information can be used to make informed investment decisions and to understand the overall performance of gold within the global economic context.

The gold market is complex and ever-changing, but real-time spot prices and historical charts provide valuable insights into its behavior. These tools can help investors identify trends and patterns, and make informed investment decisions.

EmoticonEmoticon