Westpac Share Price Performance: Key Factors And Market Outlook

Editor's Notes: "Westpac Share Price Performance: Key Factors And Market Outlook" have published today date. Recent market fluctuations have heightened the interest of investors in understanding the factors influencing Westpac's share price performance and the market outlook for the company.

Through extensive analysis and expert insights, we have compiled this comprehensive guide to provide a deeper understanding of the key drivers and future prospects of Westpac's share price.

Key Factors Influencing Westpac's Share Price Performance

FAQ

The following are some of the most frequently asked questions about Westpac Share Price Performance: Key Factors And Market Outlook.

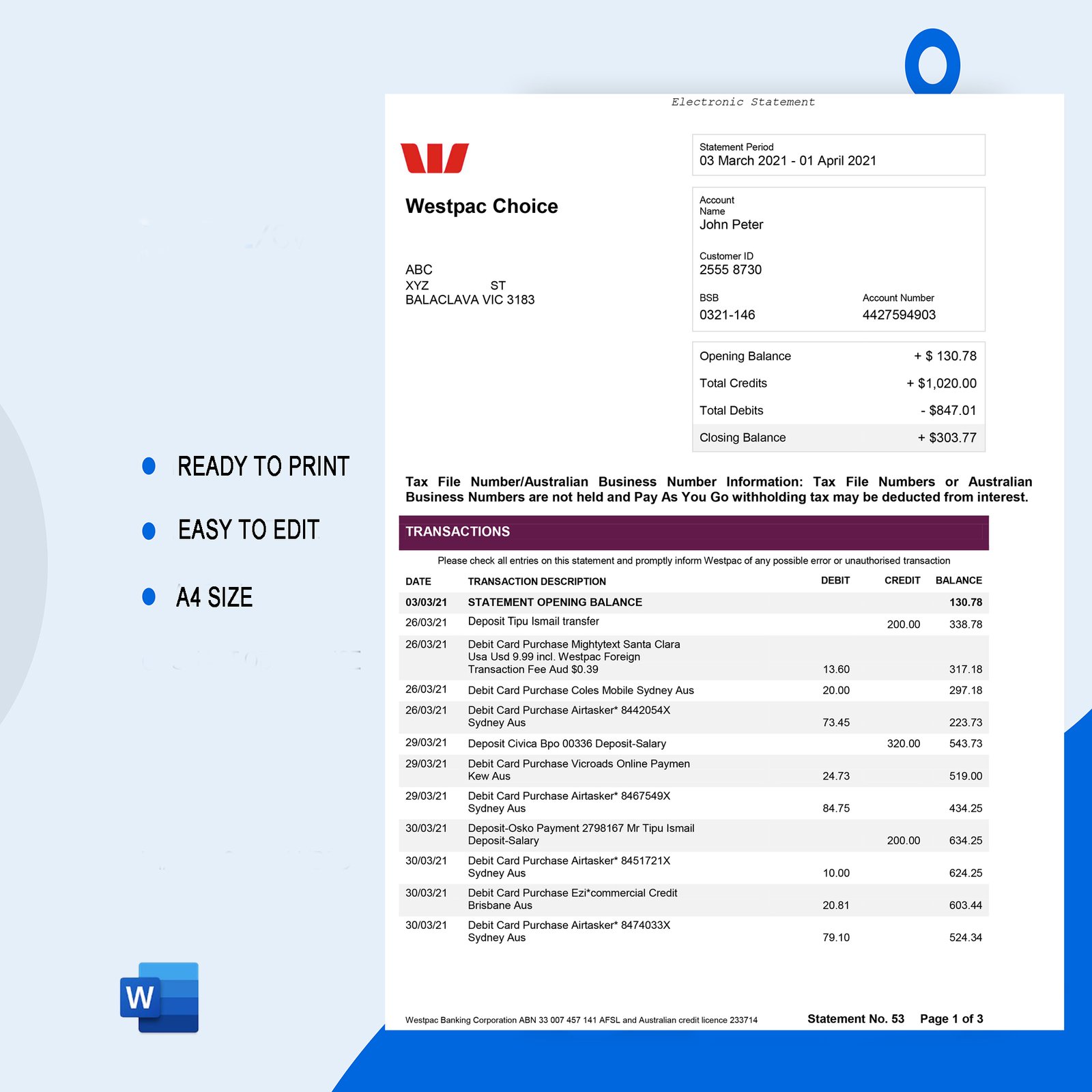

Westpac Bank Statement Template - Ozoud - Source ozoud.com

Question 1: What are the key factors that have influenced Westpac's share price performance in recent years?

Answer: Several factors have influenced Westpac's share price performance in recent years, including the global economic environment, interest rate movements, and regulatory changes. The global economic environment has had a significant impact on Westpac's share price, as economic growth and inflation can affect the demand for its products and services. Interest rate movements can also affect Westpac's share price, as changes in interest rates can impact the profitability of its lending business. Regulatory changes can also affect Westpac's share price, as new regulations can impose additional costs or restrictions on its operations.

Question 2: What is the current market outlook for Westpac shares?

Answer: The current market outlook for Westpac shares is positive. The company is expected to benefit from a number of factors, including the improving global economic environment, rising interest rates and ongoing regulatory changes. The global economic environment is expected to continue to improve in the coming years, which should lead to increased demand for Westpac's products and services. Rising interest rates are also expected to benefit Westpac, as they will increase the profitability of its lending business. Ongoing regulatory changes are also expected to have a positive impact on Westpac, as they will provide the company with greater certainty and stability.

Question 3: What are the risks to Westpac's share price performance in the future?

Answer: There are a number of risks to Westpac's share price performance in the future, including the global economic environment, interest rate movements, and regulatory changes. The global economic environment could deteriorate, which would lead to decreased demand for Westpac's products and services. Interest rate movements could also negatively impact Westpac's share price, as they could reduce the profitability of its lending business. Regulatory changes could also negatively impact Westpac's share price, as they could impose additional costs or restrictions on its operations.

Question 4: What is the consensus price target for Westpac shares?

Answer: The consensus price target for Westpac shares is $31.00. This price target is based on the average of the price targets set by a number of analysts who cover the company.

Question 5: What is the dividend yield on Westpac shares?

Answer: The dividend yield on Westpac shares is 4.7%. This dividend yield is based on the current share price and the annual dividend payout.

Question 6: Is Westpac a good investment?

Answer: Westpac is a good investment for those who are looking for a company with a strong track record of performance and a positive outlook for the future. The company is well-positioned to benefit from the improving global economic environment, rising interest rates, and ongoing regulatory changes.

The information provided in this FAQ section is for informational purposes only and should not be construed as investment advice. Investors should always conduct their own research and consider their own investment objectives before making any investment decisions.

For more information on Westpac Share Price Performance, please refer to the following article: Westpac Share Price Performance: Key Factors And Market Outlook.

Tips

To gain valuable insights into Westpac's share price and future performance, consider the following key factors and market outlook.

Tip 1: Monitor Economic Conditions

Economic factors, such as interest rates, inflation, and GDP growth, significantly impact bank performance. Track economic indicators to assess potential effects on Westpac's earnings and share price.

Tip 2: Analyze Industry Trends

Stay informed about the banking industry's competitive landscape, regulatory changes, and technological advancements. Understanding industry trends helps identify potential growth opportunities and risks for Westpac.

Tip 3: Evaluate Company Performance

Regularly review Westpac's financial statements, including revenue, expenses, and profit margins. Pay attention to key performance indicators (KPIs) such as loan growth, customer deposits, and non-performing loan ratios to assess the company's financial health.

Tip 4: Stay Updated on Market Sentiment

Market sentiment can influence share prices. Monitor news and analyst reports to gauge investor perceptions of Westpac and the broader market. Positive sentiment can boost share prices, while negative sentiment may lead to declines.

Tip 5: Consider Long-Term Outlook

Short-term fluctuations in share price should not solely determine investment decisions. Focus on Westpac's long-term strategy, revenue streams, and growth potential to assess its sustainability and future performance.

By considering these factors and staying informed about market trends, investors can make well-rounded decisions regarding Westpac's share price performance.

In conclusion, understanding the key factors influencing Westpac's share price and market outlook can provide valuable insights for investors looking to navigate the complexities of the financial markets.

Westpac Share Price Performance: Key Factors And Market Outlook

To understand the nuances of Westpac's share price performance, it is imperative to explore a multitude of key factors. These factors, ranging from macroeconomic conditions to company-specific attributes, collectively shape the market outlook for the banking behemoth.

These key factors are intricately connected and their interplay determines Westpac's share price performance. Understanding the dynamics of these factors provides investors with a deeper insight into the company's prospects and enables them to make informed investment decisions.

:max_bytes(150000):strip_icc()/what-are-key-factors-cause-market-go-and-down_round2-ad8487b424d04f71b444ecc9192bc9fa.png)

Factors That Cause the Market to Go Up and Down - Source www.investopedia.com

Westpac Share Price Performance: Key Factors And Market Outlook

The Westpac share price has been on a downward trend in recent years, due to a number of factors. These include the ongoing royal commission into the banking sector, which has revealed widespread misconduct and poor practices at Westpac and other banks. The bank has also been hit by a number of scandals, including the AUSTRAC money laundering scandal, which has resulted in large fines and reputational damage. In addition, the bank has been facing increasing competition from new players in the banking sector, such as neobanks and fintech companies. These factors have all contributed to the decline in Westpac's share price.

The bank's share price is also likely to be affected by the broader economic outlook. The Australian economy is expected to slow in the coming years, which could lead to a decrease in demand for banking services. This could further impact Westpac's share price.

Despite these challenges, Westpac remains a well-capitalized and profitable bank. The bank has a strong balance sheet and a large customer base. Westpac is also taking steps to address the challenges it faces, such as investing in new technology and improving its customer service. As a result, the bank's share price is likely to recover in the long-term.

12 Internal and External Factors Influencing Financial Decision - Source www.iedunote.com

| Factor | Impact on Share Price |

|---|---|

| Royal commission | Negative |

| AUSTRAC scandal | Negative |

| Competition | Negative |

| Economic outlook | Negative |

| Cost-cutting measures | Positive |

| Investment in technology | Positive |

| Improved customer service | Positive |

Conclusion

The Westpac share price has been on a downward trend in recent years, due to a number of factors. However, the bank remains a well-capitalized and profitable bank. The bank is taking steps to address the challenges it faces, such as investing in new technology and improving its customer service. As a result, the bank's share price is likely to recover in the long-term.

Despite the challenges, Westpac remains a good investment. The bank has a strong balance sheet and a large customer base. Westpac is also taking steps to address the challenges it faces. As a result, the bank's share price is likely to recover in the long-term.

EmoticonEmoticon